Current Market

The commercialization of the spaceflight industry is still in its formative years, evolving on an almost daily basis. Similar to the aviation industry a century ago, it is an emerging market with tremendous potential and also high risk for its participants. The capabilities and assets at KSC Space Center provide NASA with a prime opportunity to be at the forefront of space commerce while supporting the agency’s mission to “drive advances in science, technology, and exploration to enhance knowledge, education, innovation, economic vitality, and stewardship of Earth.”

Market Principles

Price Point

The key to achieving low cost access to space is to provide greater operability and responsiveness, and to increase flight system performance. Operability-centered technologies and related systems engineering can reduce the cost of space access. In the longer term, cost reduction and productivity factors need to be improved 50-100 times that of existing costs/pound to produce sustainable demand market growth. This would put the cost/pound in the sub $200 range and increase flights from 1,000 to 10,000 yearly. Achieving this price point is critical to enabling additional demand.

Supply + Demand

Supply and demand are two basic economic principles that are the twin driving forces of the market economy. A market is in equilibrium when supply matches demand and there is a balance price point that is acceptable to buyers and sellers. Currently the spaceflight market is not in equilibrium and this is preventing low cost access to space. Because of this, and because the commercial space flight industry is still developing, the market is evolving on almost a daily basis.

Benchmarking

Global Revenues and Budget

The Space Foundation Annual Space Report shows that commercial revenue and government budgets have increased for the past three years. The Ground Stations and Equipment market segment represents 34 percent of total market and shows consistent growth. Conversely, suborbital tourism makes up less than half a percent of the market, while satellite manufacturing remains a consistent market segment. These figures can be used as a global and domestic benchmark for KSC planning.

North American Industrial Classification System (NAICS) Codes

Three codes relate specifically to the spacefight industry and all are within the manufacturing sector (336414,

336415, and 336419). Over the past 10 years, the 336419 sector (space vehicle parts and auxiliary equipment) shows the strongest growth and potential. The 336414 sector (space vehicle manufacturing) had a larger increase in establishments, but a reduction in the value of shipments, indicative of a more competitive sector. The 336415 sector (space vehicle propulsion) had growth in establishments, shipments and payroll but a reduction in employees. These sector codes can be tracked at a national and regional (Florida, Georgia, and Alabama) level to monitor economic changes in the spaceflight market.

Customers

In 1958, legislation generally referred to as the Space Act, authorized NASA to enter into

partnerships with the private sector, academia and other public entities to carry out its broad

mission. Current customers represent a strategic shift in KSC operations from solely government-focused to a broader diversity of users. That is, KSC is becoming a distinguished partner with members of the spaceflight industry by sharing its physical assets, support services and technical expertise. Since the signing and implementation of the NASA Authorization Act of 2010, additional emphasis has been placed on supporting the American commercial space industry by minimizing the regulatory burden for commercial space activities while ensuring that the regulatory environment for licensing space activities is timely and responsive.

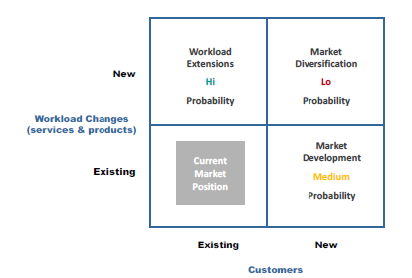

KSC has the opportunity to expand and deepen these burgeoning relationships, especially with companies that operate in more than one submarket or portion of the supply chain. The graphic below depicts the market movement for KSC with the highest probability of success based on existing services and customers.

Other Spaceport Competitors

The competition for commercial launches is dynamic. International competitors are often able to offer lower prices due to government subsidies or a different regulatory environment. Domestic entities exist at both federal and non-federal spaceports with a range of specializations. KSC can monitor the domestic spaceport license activity and news of keydomestic and international market players to observe and assess how other market participants are evolving. This will help KSC better understand its role in the industry and how it can develop a competitive position in the spaceflight market.

Existing Strengths, Limitations and Future Risks

KSC Space Center possesses distinct, unique strengths and qualities that made it an attractive location in the early days of human spaceflight. Today, with its land, existing infrastructure, support capabilities, and marketable legacy reputation, KSC has considerable capacity to grow in both number of users and the diversity of space-related activities. In addition to these unique features, KSC has the advantage of proximity to Florida’s High Tech Corridor, as well as the presence of a regional economic development initiative involving the University of Central Florida, the University of Southern Florida and the University of Florida, which aims to grow the high tech industry and spur innovation that supports research, marketing, workforce, and entrepreneurship. In addition, the broader KSC community offers human capital expertise in the fields of engineering, technology, sciences, hardware integration, program/project management, and construction. All of these factors enhance the ability to capitalize on new markets and respond to the rapidly evolving space industry opportunities

Partnering with local and regional Economic Development Organizations (EDOs) can enable economic clusters in Florida’s High Tech Corridor to be leveraged and strengthen KSC’s gravitational pull within the launch services supply chain, using KSC’s resources to efficiently advance the space industry. Available infrastructure, labor, and human capital constitutes a critical near-term advantage, but only if these capabilities are promoted and new businesses are identified. The essential role of an EDO is to act entrepreneurially to aggregate all of the community’s advantages, recruit employers and close business deals.

Market Segments / Ancillary Markets

There are multiple ways to segment the spaceflight industry. As part of the Master Planning process, 10 sub-markets were identified with defined classifications, providing a framework to use in analyzing each market and identifying relevant opportunities that fulfill KSC’s vision of becoming a multi-user spaceport. The market segments below represent the 10 market segments identified to be the most relevant to today’s evolving space industry in relation to KSC’s commercialization and programmatic efforts.

Space Transportation and Technologies Support System

Core Sub‐Market; Low Cost but reliable launches.

Countries seeking to become space faring nations typically focus their efforts on developing appropriate satellites/payloads and look to purchase a ride on a launch vehicle. A premium is placed on low-cost, reliable launch services. Today, the majority of international customers are buying launch vehicles and launch services from China, the European Space Agency (ESA) and Russia. Countries such as Japan and India are rapidly becoming viable providers of launch services, while several other countries (Brazil, Israel and South Korea) are nearing the time when they can offer similar services.

KSC Opportunities

- Actively support commercial space launch providers with responsive infrastructure upgrades and support to multiply effectiveness, increase competition, and lower costs.

- Provide support services for both traditional launch operations and independent spaceflight operators

Satellite Systems and Payloads

Core Sub-Market; Focus on small/nano satellites

Satellites represent the bulk of all space launch markets and have the broadest application to consumer and military markets, with concentration on communication and global monitoring. Large satellites will continue to require heavy-lift capability, which Florida’s extensive space infrastructure supports. Small satellites offer a cost-effective option and new possibilities in the areas of defense, communication systems, scientific research and environmental monitoring. The small satellite sector, including pico and nano satellites, will continue to gain momentum because the small satellites are relatively fast and inexpensive to develop and launch on smaller rockets.

KSC Opportunities

- Work with the Air Force to develop an efficient, user-friendly launch process for heavy, medium and small lift vehicles

- Advocate for supportive NASA, DoD, and FAA policy and legislation to enable industry and university efforts related to satellite operations, launch and research

- Create small satellite launch, processing, research and supply chain cluster in Florida, coordinating efforts with heavy-lift suppliers and Eastern Range operator

- Support industry activities such as workshops, conferences, intern programs, research networks, etc.

- Leverage KSC’s assets, and the Space Coast industry cluster and culture

Ground and Operations Support Systems

Core Sub-Market; Differentiate with an economic cluster, providing lower costs

Ground support operations activities have historically been accomplished at a great distance from the launch site utilizing the “Ship and Shoot” method, in which launch vehicle elements such as boosters and payloads are shipped from the prime manufacturer to the launch center, where they undergo final assembly, checkout and integration activities preceding launch. In this scenario every failed element must be returned to the vendor for troubleshooting and repair for all but the simplest of problems. Alternatively, some contractors have a permanent delegation in residence at the launch site that can provide the technical expertise to resolve any required failure analysis, part replacement and/or repair and re-test needed to ensure the flight elements are ready on a timely basis for flight.

KSC Opportunities

- Leverage the advantages of ground support operations in proximity to launch sites and other government and privately owned infrastructure

- Use Space Florida’s financial capabilities to develop multi-use infrastructure resources that enable ground support operations, providing launch operators with the option of buying services “by the yard”.

- Cluster ground support operations to serve multiple co-located launch operators utilizing KSC’s existing infrastructure, available developable land, and human capital to help decrease the cost of space access.

Agriculture, Climate, and Environmental Monitoring

Part of Programmatic efforts; Aligns with protected areas on KSC, part of NASA programmatic work

Florida’s leadership in the industries of agriculture, life sciences and environmental Stewardship are poised to intersect with aerospace sectors to provide an array of opportunities for research, business development and environmental monitoring. In the areas of Earth observation, data collection, modeling and research, opportunities exist for KSC to build upon its existing research capabilities through further collaboration with nearby universities and other local organizations.

KSC Opportunities

- Support continued agriculture research by universities in SLSL

- Facilitate university/industry working groups

- Work with EDC & Space Florida to develop special incentives for space-related agriculture and environmental companies

Civil Protection and Emergency Management

Sub-market alignment with satellites; provides socially aware focus

Civil Protection and Emergency Management include activities in sectors that deal with and

minimize impacts and risks from natural disasters and human conflict before they occur, such as

evacuations before events; quarantines during events; and civil order, rescue and rebuilding in the aftermath. Communications and data technology reliant on satellites and aerospace-developed systems are key in increasing the timeliness and success of the response before, during and after emergency events.

KSC Opportunities

- Partner with the Florida Emergency Preparedness Association and Division of Emergency Management.

- Support emergency management applications of technologies required for satellite and ommunity data acquisition, analysis and integration, and communications systems

ISS and Human Life Sciences

Sub-market alignment with satellites; provides socially aware focus

Since the International Space Station (ISS) was declared a National Laboratory in 2005, KSC and the Space Coast have emerged as the best location to host affiliated ground-based research, suppliers and science-based payload processing. While NASA research on the ISS looks out into the universe, ISS facilities dedicated to the National Lab will focus inward on Earth research, facilitating breakthrough scientific discoveries that improve the lives of the inhabitants of Earth. This research also helps generate additional opportunities for STEM students, strengthening ties with academic institutions in the emerging “High-Tech Corridor” in east central Florida. This sub-market fully aligns with one of NASA’s strategic goals to “Create the innovative new space technologies for our exploration, science, and economic future” and is supported by KSC’s core competencies.

KSC Opportunities

- Engage in education programs with R&D entities not yet aware of the benefits of research and testing in space or significance of ISS National Lab designation opportunity

- Leverage capabilities of ISS National Lab designation by promoting consortium partnerships (academia, other R&D industries), Exploration Park, and SLSL capabilities

Communications, Cybersecurity and Robotics

Sub-market to provide collaboration on opportunities; differentiate KSC with proximity to high tech corridor

Aerospace-based communications systems comprise a key component of the world’s critical information and communications technology infrastructure. Much of the advanced software and

systems developed for aerospace applications also present great crossover opportunity to build key target industries for Kennedy in information security and robotics. Cybersecurity includes software and monitoring activities that protect computers, networks and communications from accidental or malicious harm. It is key to trade, defense, transportation and crime prevention. Robotics, relied upon heavily in space exploration, has intersecting applications in manufacturing, medicine and processes carried out in harsh environments.

KSC Opportunities

- Collaborate with cluster of companies in High-Tech Corridor, leveraging KSC’s proximity to create more opportunities for potential partnerships and take advantage of the opportunity to share services and resources

- Work with related industries to capture programs that help Florida build presence in the growing markets for consumer-oriented products and services including satellite TV and broadband, training and distance learning and mobile technologies.

- Consider partnerships with key IT industries including cluster trade groups, research centers and related companies developing advanced software for cyber security and robotic systems.

Adventure Tourism

Core Sub-market; consistent part of commercialization efforts with a longer-term focus

Space tourism includes activities with space themes available to the general public for entertainment purposes on the ground, in the air or in space. Extreme adventure space experiences could eventually include suborbital options that launch and land at the same site and those that launch tourists, take them into space and land at another site. Several of KSC’s current and prospective partners are developing technology and capabilities that will allow them to enter and expand this market.

KSC Opportunities

- Work with Space Florida to enhance the SLF’s multi-use capability to accommodate the infrastructure and services necessary to support adventure tourism options

- Collaborate with the Brevard EDC and local business groups to promote potential adventure tourism initiatives, ensuring that KSC and its partners in Brevard County are working together to advance this industry

Clean Energy

Core sub-market; Sustainable focus that differentiates KSC

The state of Florida leads the nation in usage of fossil-fueled power, producing 127 million metric tons of CO2, 6 percent of the nation’s total. To counteract this negative impact on the environment, the Florida Governor’s Energy Office has identified solar (photovoltaic), offshore wind and biomass (solid) as power sources with the most potential for the state. In coordination with other state agencies such as the Department of Environmental Protection (DEP), Florida Energy & Climate Control Commission, and Florida Energy System Consortium, efforts are being initiated to build upon the emergence of solar farms and other clean energy efforts, capitalizing on the state’s pursuit of lowering its CO2 emissions.

KSC Opportunities

- Continue to pursue opportunities with Florida Power and Light and other companies to utilize KSC’s vast amount of land resources, outlined in the center’s strategy to convert fallow orange groves to renewable energy uses.

- Collaborate with Space Florida to work with local governments to create appropriate incentives, taking advantage of the state’s special district monetary and tax provisions outlined in its Charter.

Advanced Materials and New Products

Part of Programmatic efforts; supports one of NASA’s strategic goals and provides STEM exposure

The markets of interest to KSC are heavily dependent on advanced materials and technologies. Research laboratories at KSC and nearby industry and academic institutions are at the leading edge of technology innovation and application. This sub-market, along with Life Sciences, firmly supports one of NASA’s strategic goals to “Create the innovative new space technologies for our exploration, science, and economic future.” This should continue to be a key focus area for KSC and is supported by its core competencies.

KSC Opportunities

- KSC and its partners should become a recognized focus point for the development and use of advanced materials and technologies for space applications which also have broader application potential for other disciplines and markets (such as energy, agriculture, life science, etc.).

- Develop capability to manufacture large scale hardware elements associated with exploration.

- Be at the forefront of developing solutions to in-orbit fueling for Earth departure vehiclesand radiation protection for long duration space exploration operations.

- Be a leader for extraterrestrial surface operations, including habitation, in situ resourceutilization, launch, logistics, etc. (in direct support of KSC’s chartered tasks).

- Enable the use of high technology and advanced materials in support of the energymarket (power generation, transmission and storage).

- Promote the use of high technology and advanced materials for: 1) increased efficiencyof operation for traditional internal combustion engines and 2) the introduction of alternative fuels and/or propulsion devices for both stationary and vehicular applications.